are federal campaign contributions tax deductible

Contributions or donations that benefit a political candidate party or cause are not tax deductible. Each of these zones has.

Their spending such.

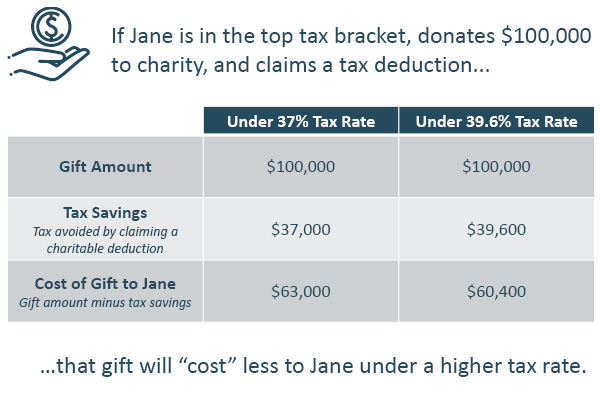

. There are five types of deductions for individuals work-related itemized education healthcare and investment-related deductions. Tax Consulting Help from Plano Tax Prep. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases.

Can I deduct campaign contributions on my federal income taxes. The IRS has clarified tax-deductible assets. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Among those not liable for tax deductions are political campaign donations. The Natural State grants tax credits for statenot federalcampaign contributions of up to 50 for an individual 100 for a couple and it can be spread over multiple candidates political action committees approved by Arkansas and parties.

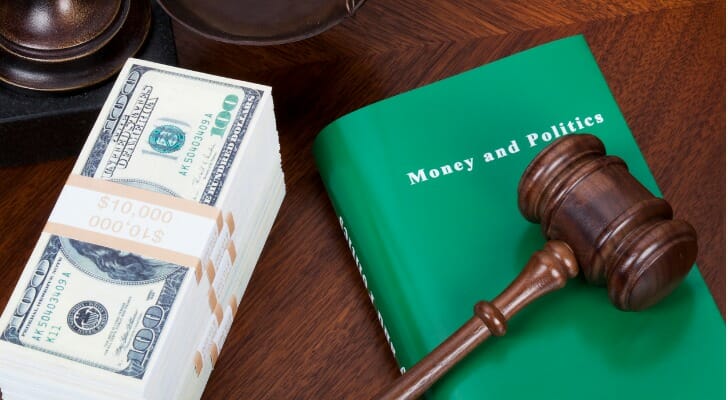

Just know that you wont be getting a federal tax break. With the election about to ratchet up into high gear people on both sides of the aisle have started donating to political campaigns. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. If you want to contribute but arent up to make a huge donation you also have the option to set aside 3 of your taxes as a part of the Political Action Committees.

In other words you have an opportunity to donate to your candidate campaign group or political action committee PAC. That includes donations to. Figuring out tax contributions and other deductions can be a full-time job.

Can I deduct campaign contributions on my federal income taxes. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. A tax deduction allows a person to reduce their income as a result of certain expenses.

This can be done on your 1040 federal income tax return. An official website of the United States government. Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a.

Like Arkansas Ohio only allows for contributions to candidates in statewide elections. Even this far out presidential candidates are already in a fundraising frenzyHillary Clinton raised 28 million in the past three months aloneand the numbers are. Political contributions deductible status is a myth.

Heres how you know. Payments made to the following political causes are also not tax deductible. Thank you for contributing through the Combined Federal Campaign CFC.

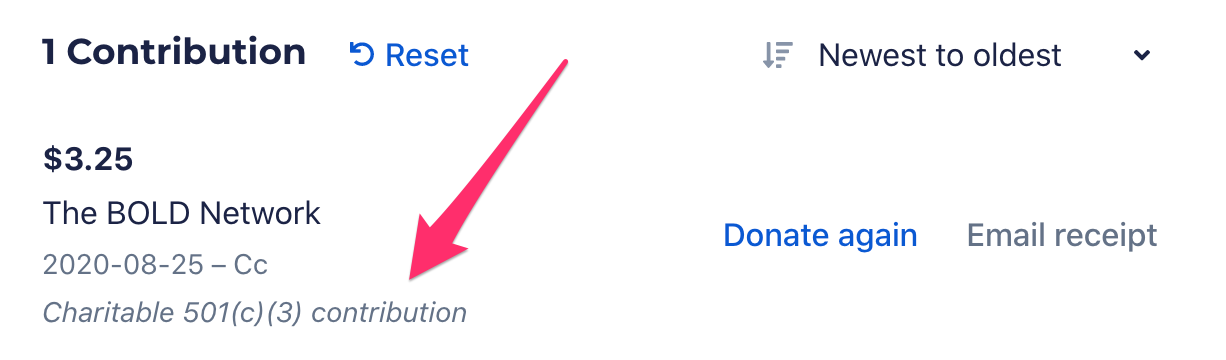

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Cost of admission to a political event including dinners that benefit a. And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction.

The CFC is comprised of 30 zones throughout the United States and overseas. Can I deduct campaign contributions on my federal income taxes. You can obtain these publications free of charge by calling 800-829-3676.

Each of the types of deductions has subcategories such as charitable contributions student loan interest and capital losses. Those that choose to join a campaign group or political organization are allowed. Your tax deductible donations support thousands of worthy causes.

Are Political Contributions Tax Deductible Smartasset

Tax Deductible Donations Can You Write Off Charitable Donations

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Do I Qualify For New 300 Tax Deduction Under The Cares Act

Are Political Contributions Tax Deductible Smartasset

Ethics Of Tmj Treatments The Tmj Association

Are Your Political Contributions Tax Deductible Taxact Blog

Tax Deductions For Donations In Europe Whydonate

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Template Donation Letter Donation Thank You Letter

Are Political Donations Tax Deductible Credit Karma

Tax Policy Changes And Charitable Giving What Fundraisers Need To Know Ccs Fundraising

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

Which Charitable Contributions Are Tax Deductible Buy Side From Wsj